Want more Info or a Demo?

Provide your details and we'll contact you after the event.

Compliance through convenience

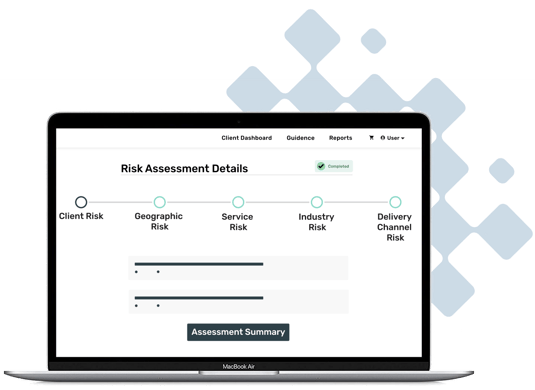

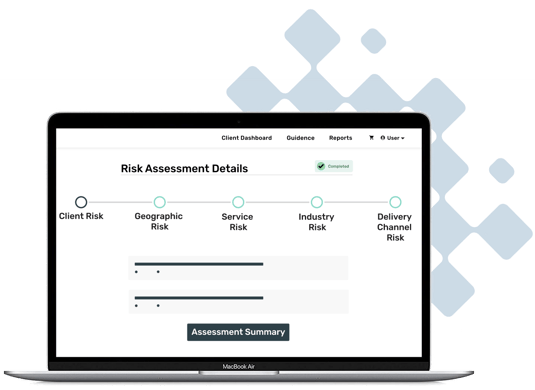

Creating a risk assessment is essential, but it doesn’t have to be difficult.

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

-

Assess the level of risk associated with their firm

-

Use a risk-based approach to prevent money laundering

-

Create robust policies, procedures, and controls that actively reduce the risk of financial crime

-

Make informed decisions about clients

-

Evaluate risk reduction measures

-

Identify transactions and relationships that involve an at-risk or sanctioned party

Tailored policies and procedures to suit your firm

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

-

A risk-based approach, risk assessment, and management

-

Client due diligence

-

Record keeping

-

Internal control

-

Ongoing monitoring

-

Reporting procedures

-

Compliance management

Fast, simple and secure client due diligence

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

-

Official company information checks

-

Beneficial ownership verification

-

Document proof and data extraction

-

Biometric facial recognition

-

Liveness check includes video and motion capture

-

Configurable sanctions and PEP & screening

Compliant by design, make your audits as painless as possible

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

-

Assess compliance and achieve compliance assurance

-

Identify compliance gaps

-

Ensure CDD documentation and evidence are readily available for inspection

-

Review and respond to changes in your practice and legislation

CPD content tailored to fit the needs of your company's requirements

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

-

Virtual CPD conferences courses and webinars

-

Download all supplementary training documentation

-

Regular review and update

-

Documented record of all training maintained

Creating a risk assessment is essential, but it doesn’t have to be difficult.

Anti-money laundering risk assessments are an essential part of preventing financial crimes and following regulatory mandates. Every practice must adopt a risk-based approach to AML, including having an AML risk assessment to keep your firm safe from money laundering and counter-terrorist financing.

AML HQ can quickly help you construct an effective risk assessment methodology that is cost-efficient and easy to implement. Our online risk assessment is designed to bring together every question you need in one easily editable document. The questions address risks collated from multiple sources.

A risk assessment helps to;

-

Assess the level of risk associated with their firm

-

Use a risk-based approach to prevent money laundering

-

Create robust policies, procedures, and controls that actively reduce the risk of financial crime

-

Make informed decisions about clients

-

Evaluate risk reduction measures

-

Identify transactions and relationships that involve an at-risk or sanctioned party

Tailored policies and procedures to suit your firm

Firms must establish and maintain a framework of policy controls and procedures to mitigate and manage the risks of money laundering. To identify, monitor, evaluate and manage the risks, the framework should be proportionate to the size and nature of the business.

AML HQ provides you with a full framework of policies, controls, and procedures that can be further tailored to your firms’ requirements. We will notify you with updated guidance from competent authorities across the UK and Ireland.

Our policies, controls and procedures cover every area of anti-money laundering compliance your firm might need to consider;

-

A risk-based approach, risk assessment, and management

-

Client due diligence

-

Record keeping

-

Internal control

-

Ongoing monitoring

-

Reporting procedures

-

Compliance management

Fast, simple and secure client due diligence

The purpose of client due diligence is to know and understand a client’s identity and business activities so that money laundering risk can be properly managed. Effective CDD, is therefore, a key AML defense. By knowing the identity of a client, including who owns and controls it, a business not only fulfills its legal and regulatory requirements, it equips itself to make informed decisions about the client’s standing and risk.

Our solution helps you onboard clients quickly and securely by using a combination of digital, physical, and biometric checks.

Our client due diligence process can be tailored to suit your needs and includes;

-

Official company information checks

-

Beneficial ownership verification

-

Document proof and data extraction

-

Biometric facial recognition

-

Liveness check includes video and motion capture

-

Configurable sanctions and PEP & screening

Compliant by design, make your audits as painless as possible

Audits often take up valuable resources within firms which end up costing time and money. AML HQ achieves compliance through convenience. Our automated processes help you work more efficiently whilst reducing friction points for you and your clients.

At any time you can run an instant firm-wide anti-money laundering compliance report. This is particularly useful to inform management on risk, allocate team resources or prepare for impending audits. At the touch of a button, our audit functionality allows you to produce comprehensive auditor extracts to evidence and demonstrate compliance.

Our tailored processes help you;

-

Assess compliance and achieve compliance assurance

-

Identify compliance gaps

-

Ensure CDD documentation and evidence are readily available for inspection

-

Review and respond to changes in your practice and legislation

CPD content tailored to fit the needs of your company's requirements

All professionals should receive continuing professional development (CPD) appropriate to their role. AML HQ provides you with the ability to track your staff’s training schedules and identify if there are any training gaps.

AML HQ provides access to a series of online CPD training webinar videos, on a variety of essential subjects and topics, available for purchase for accountants, solicitors or designated persons in a compliance role

Each CPD course gives you access to;

-

Virtual CPD conferences courses and webinars

-

Download all supplementary training documentation

-

Regular review and update

-

Documented record of all training maintained

Low annual access fees

with additional services available on demand

Business Plus

up to 100 clients

€45

plus VAT, per month

Secure data storage / GDPR compliant

Policies and procedures

Risk assessments

Company information

Client identification

Track staff training

Beneficial owner information and enhanced client verification

Both available upon request

Premium

up to 300 clients

€75

plus VAT, per month

Secure data storage / GDPR compliant

Policies and procedures

Risk assessments

Company information

Client identification

Track staff training

Beneficial owner information and enhanced client verification

Both available upon request

Custom

300+ clients